How to conduct Source of Funds and Source of Wealth verification on corporate clients

Published

Harriet Holmes

Senior AML Enablement and Product Assurance Manager

Understanding the nature, background and circumstances of the client, including their financial position, is a critical part of our client due diligence process. Depending on the size and nature of the transaction, you may need to consider not only the source of funds and AML risk associated with your client but also the business risk and financial stability of the corporate entity instructing you.

From a pure AML perspective regulated firms and their employees must take adequate measures where necessary to establish the source of wealth and funds involved in the business relationship and subsequent transactions to satisfy themselves that they do not handle the proceeds of corruption or crime.

Start by asking yourself this pivotal question. How could a corporate entity be used to launder money?

What is Source of Funds (SoF)?

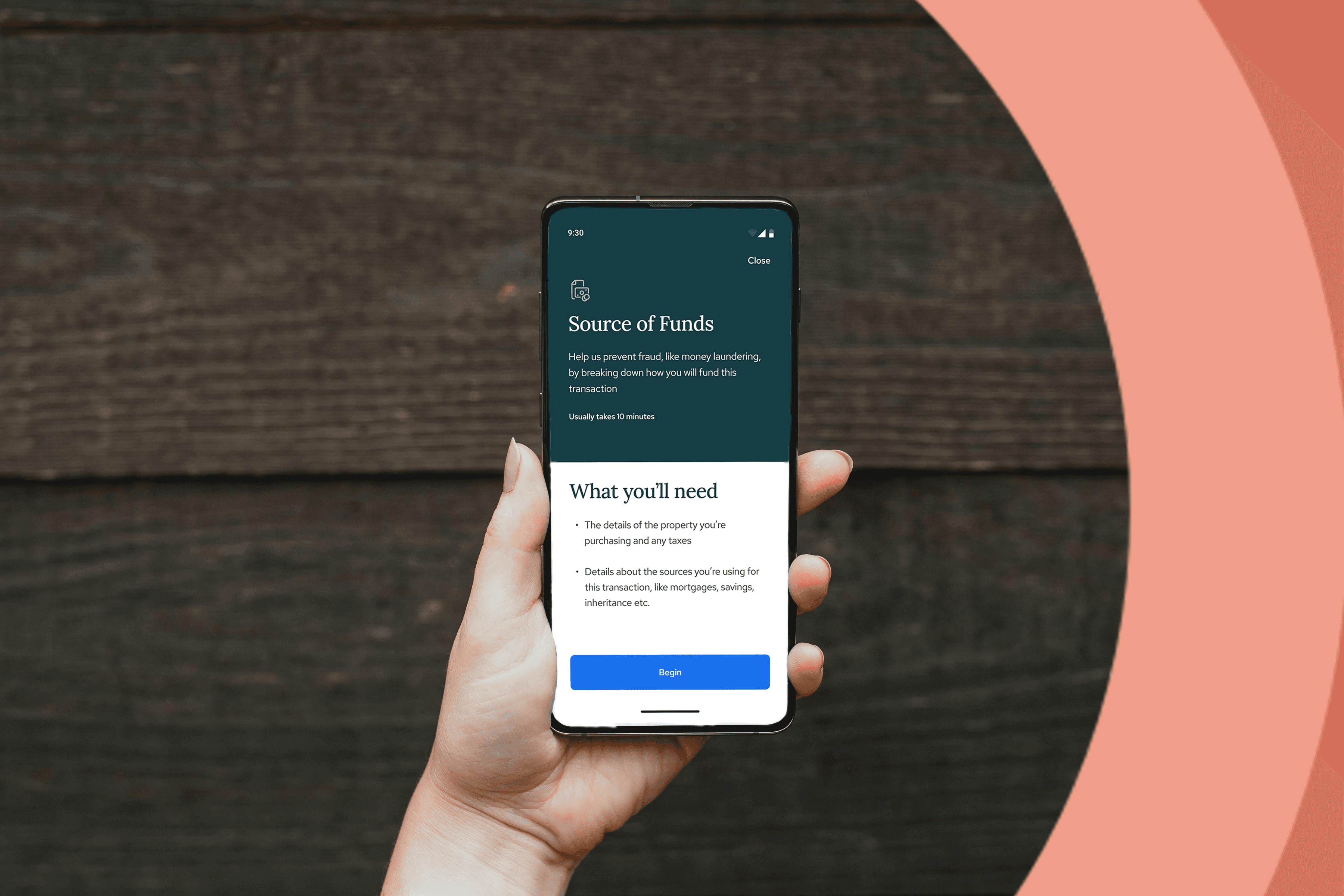

Source of Funds is a term that describes the origins of money that an individual or organisation uses to finance the transaction at hand. In establishing the source of funds, we must understand where funds came from and the activity involved in generating the funds.

Examples of common sources of funds within a company:

Raising capital through debt.

Raising capital through equity.

Raising capital through Government incentives.

Retained Earnings.

Funding from Personal Savings.

Funding sources can also include; private equity, venture capital, crowdfunding, donations, grants, and subsidiaries.

Depending on the given explanation, the direction of further enquiries may alter. For example, if it is the personal savings of a director, you should follow the trail to understand the ultimate origins and the activity that generated those funds.

Where to start

Corporate entities can be exploited in this process through various methods such as false invoicing, shell companies, or complex transactions that obscure the money's original source.

When considering a clients source of funds for a specific transaction we should focus on two areas:

The original funds that were injected into the company.

The continuous monies which enable the entity to continue trading.

Each can affect the risk profile and subsequent due diligence that may follow (the focus on each could alter dependent on the time span since incorporation).

It's important to identify various scenarios that might occur. For example, a company may initially use low-risk funds from a legitimate source, but later, the incoming money could be high-risk. An example is a company that initially receives funds from a regulated financial institution. Still, its day-to-day business operations involve a cash-intensive barber shop, which could be vulnerable to money laundering. On the other hand, a company might start with high-risk investment money, but later funding could be legitimate and inherently low-risk. This company could initially receive funds from a sanctioned Russian Oligarch investor, but its business operation involves supplying office stationery to the government. Both scenarios are higher risk.

The level of detail and corresponding evidence will depend on the risks presented by the client and the relevant transaction, with no one size fits all answer available. In order to apply a risk-based approach, you will likely need to start by being curious about the company more generally. Asking questions and building a picture to make informed decisions on next steps such as:

Where is the client incorporated?

How long has the client been established?

What sector does the company operate in?

What are the day to day business activities?

Who are the main shareholders and beneficial owners?

Who controls the company?

A practical process

You are not required to go seeking out crime or corruption. For example, you are not required to undertake detailed due diligence of a business to see if they ever failed to pay for a required regulatory licence.

But you are required to consider whether the source of funds is consistent with their:

Risk profile.

Transaction.

The nature of the business (including day-to-day activity and financial profile).

Here are some specific questions you may wish to consider:

Do you understand the names of the ultimate beneficial owner(s)? Have they been identified and verified?

Do you know and understand the full names of the investors/funders? Have they been identified and verified?

Is the funding provider an entity? If so, are they regulated? If yes, the risk will be significantly reduced and directly affect the level of due diligence.

What was/is the purpose of the funding? If the funder has no apparent link to the entity, do you understand why they are providing support?

Is the funding structure complex, unusually large, unusual or has no apparent economic or legal purpose?

Why is the funding being sourced in this way? Are you comfortable with the narrative you are given about why this funding model is being used?

Is the funding intended to purchase an asset, or could it be recoupable somehow?

If it is a non-regulated entity or funding from individuals, who can you identify/verify? Certain funding structures will make it difficult to conduct due diligence on every funding source, especially in situations such as crowdfunding. However, you should identify and verify all relevant parties. If you cannot, carefully consider how you proceed. This may include identification and verification of the individual(s) behind the idea, those controlling the funding or those donating over a certain percentage of the funds (should one individual donate significantly more than others). You should ensure you are comfortable answering why you have gathered adequate due diligence.

If the payment is coming from an electronic payment service to transfer funds, is it regulated? If not, consider what controls does the service have in place?

How should you source information relating to Source of Funds?

Documentation may emanate from a number of sources. The type of evidence required for SoF corroboration depends on the specific source (origin and means of transfer). These documents differ in their integrity, reliability and independence.

Latest audited accounts.

Information from a reputable electronic verification service provider.

Information on the companies or parent company's websites.

Statement from a bank, building society or credit union.

Financial statements presented to the annual general meeting.

Corporate filings confirming the full names of beneficial owners or self -declaration.

For UK-registered companies, all private limited and public companies must file their accounts at Companies House. Generally, accounts must include profit and loss accounts and a balance sheet signed by a director on behalf of the board and the printed name.

Electronic company search providers can help you identify the ultimate ownership structure and ultimate beneficial owners. Once you are aware of the individual(s) you can utilise technology to ensure you obtain independent secure verification of that individual's identity.

However, for all companies, especially those outside of the UK where records are not as accessible, a reputable electronic screening provider can support you in collating the required due diligence for review, including copies of any relevant fillings annual accounts.

The variables are vast, but if the transaction, information and evidence are consistent and you do not suspect criminal property is involved, you do not have to go further to prove that the funds are clean.

It is essential to keep a record of all questions, answers provided, and supporting materials received in case of any future inquiries from an auditor, regulator or law enforcement. While you are not required to conduct a full forensic investigation, ensuring that the funds used in the transaction are not derived from criminal activity is important.

We should all maintain a curious mindset and remember that performing source of funds checks ultimately helps prevent criminals from using the proceeds of crime.

Subscribe to our newsletter

Subscribe to our monthly newsletter for recaps and recordings of our webinars, invitations for upcoming events and curated industry news. We’ll also send our guide to Digital ID Verification as a welcome gift.

Our Privacy Policy sets out how the personal data collected from you will be processed by us.