Identify high-risk clients easily

Manage the risk of working with politically exposed individuals or sanctioned entities. Using live data from thousands of sources, our automated PEPs and sanctions screenings help you stay on top of changes.

Join over 1,500 regulated businesses relying on us for client verification

Never miss an update

Reliable data sources that are updated every few minutes.

Automated

Ongoing monitoring means you’ll be notified if a client’s status changes.

Fast

Rapid, actionable results mean less time spent reviewing matches.

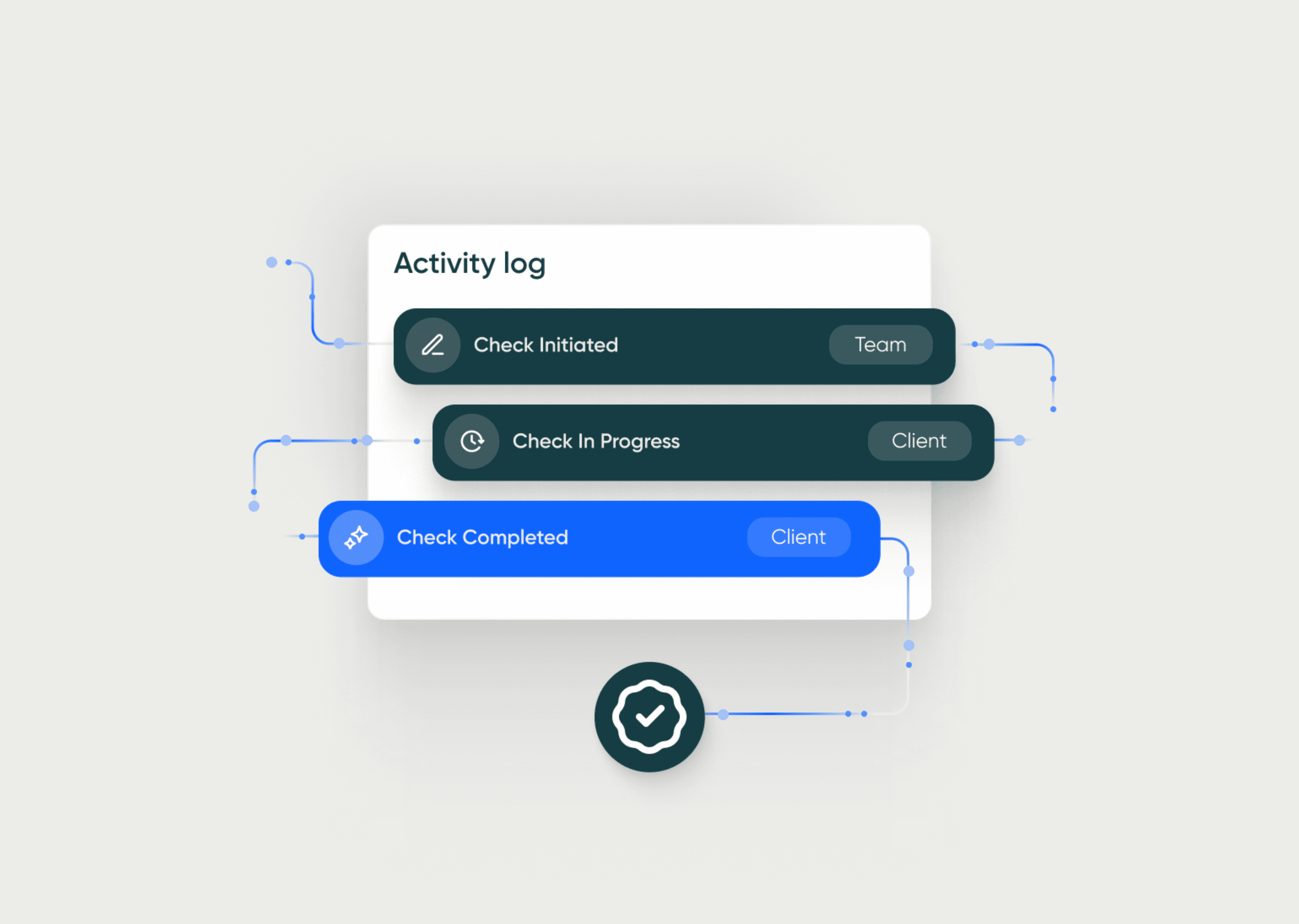

How it works

Step 1

Choose a PEP & sanctions screening through our portal or partner platform.

Step 2

We’ll screen your individual and corporate clients for PEPs and sanctions flags.

Step 3

You’ll be able to view your results in a few moments.

Step 4

Continue with ongoing monitoring for as long as you need.

Thirdfort's ongoing monitoring provides an extra layer of protection so that during the six or so months that clients are with us, we know that they're constantly being monitored

In terms of the report that we receive, it's standardised. So it's very easy to train people on how to read them and what they should be looking for

Screen clients and counterparties with ease

Unlike other providers we don't ask you to enter lots of data to screen your clients.

We check global data sources that are frequently updated.

Stay in the know

Protect yourself and your firm for the duration of your business relationship.

Be notified of any changes in status or if an individual falls under new sanctions.

Keep a clear audit trail

PEPs and sanctions screening results are combined in one report along with ID verification and Source of funds.

You can dismiss any false positives within our portal. We'll create an audit trail for you.

FAQs

Protect your firm from high-risk clients

Remove uncertainty with our PEPs and Sanctions screening - and keep up to speed with changes as they happen with ongoing monitoring. See how it works when you book a demo.