Client funds analysed so you can ditch the highlighter

Create a full picture of your clients' Source of Funds with transactions analysed and evidence gathered without all the back and forth.

Join over 1,500 regulated businesses relying on us for client verification

Fast

Instant access to your client's bank statements and supporting evidence.

Secure

Eliminate the risk of statement tampering or interception through email or post.

Clear

Transaction analysis and highlighted risks show you exactly where funds come from.

How it works

Step 1

Choose Source of Funds verification through our portal or partner platform.

Step 2

Your client will receive an SMS with instructions to download our app.

Step 3

Next, they’ll complete a questionnaire, securely share bank statements via open baking, PDF or image upload and provide supporting evidence.

Step 4

Once they’re finished, you'll receive report that highlights what's important, where the data correlates and where it doesn't.

[The] Source of Funds report and Open Banking helps to quickly gather and interpret information about our clients and to spot anything suspicious or requiring more attention.

JCP Solicitors

If the app was not as smooth and as slick as it is, a fake bank statement may have slipped through the net.

Thomas Flavell & Sons Solicitors

Analyse client’s bank statements no matter how they’re shared

Clients have the option to share their bank accounts simply and securely in a few clicks via open banking, image or PDF upload.

Get all the information you need in one go with the ability to link or upload statements from multiple accounts.

Open banking provides reassurance that statements are genuine and free from interception, with our PDF and image upload options giving the flexibility your clients need.

Secure data gathering through our app

Clients provide details about their relevant funds through our simple app journey.

Questionnaire responses are compared to the data gathered from digital bank statements, substantiating claims and highlighting inaccuracies.

Our giftor Source of Funds questionnaire quickly verifies monetary gifts.

The proof you need, up front

If clients declare mortgage, inheritance, sale of assets, divorce or savings they'll be automatically prompted to upload supporting evidence, directly within the app. One easy journey for your clients, one simple report for your team.

Need more? Further documentation can be requested and securely uploaded in the Thirdfort app.

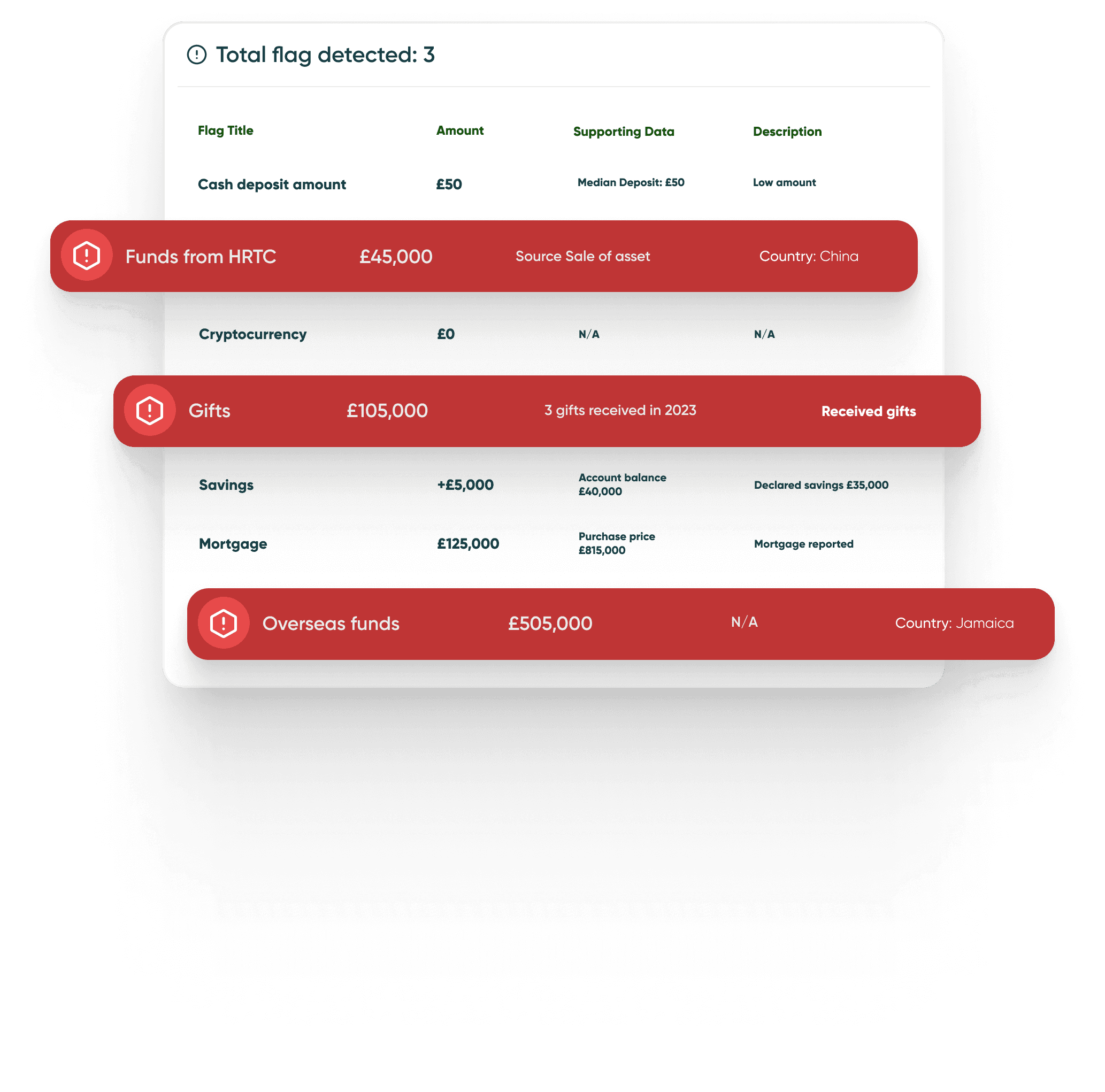

Red flags highlighted

We highlight red flags within your client funds, giving you immediate visibility on areas that need further analysis or evidence.

See funds coming from High Risk Third Countries, cash deposits and cryptocurrency to aid enhanced due diligence.

Thorough, thoughtfully designed bank data analysis

Get the full picture with 6 months of balance trends and key transactions.

Easily review income with salary transactions collated and summarised.

Highlights large, recurring, cash and other high-risk transactions and trends.

Maximum visibility with bank statement data and additional documents provided in full.

Get the full picture

Keen to level up your Source of Funds verification? We're ready when you are. Get started with a demo today.