You do the deals. We'll do the verification.

Join over 1,500 regulated businesses relying on us for client verification

Speedy

Win back time usually spent on client due diligence.

Compliant

KYC and AML verification that meets HMRC’s requirements.

Easy

Your clients complete their checks from the comfort of home.

Secure

ISO 27001 compliant.

On average remote ID verification is completed in just

14 hours

ID Verification

Remotely verify vendors, buyers, tenants and landlords so you can keep your business moving while protecting your firm from fraud and its repercussions.

Document Verification

Take the pressure off your sales negotiators to identify fraudulent identity documents with our extensive and automated check.

PEPs and Sanctions

We tap into thousands of live data sources to screen individuals and companies, so you know exactly who you’re dealing with.

Source of Funds

Qualify buyers by gathering bank statements and evidence that they are ready to make an offer, without all the back and forth.

Having a platform which obtains digital ID, AML and source-of-funds verification gives our sales teams time back to focus on selling.

It offers our clients and staff a more streamlined and secure approach to KYC, AML and Source of funds checks

Helping letting agents meet new compliance requirements with confidence

Trusted by over

1,500

regulated businesses

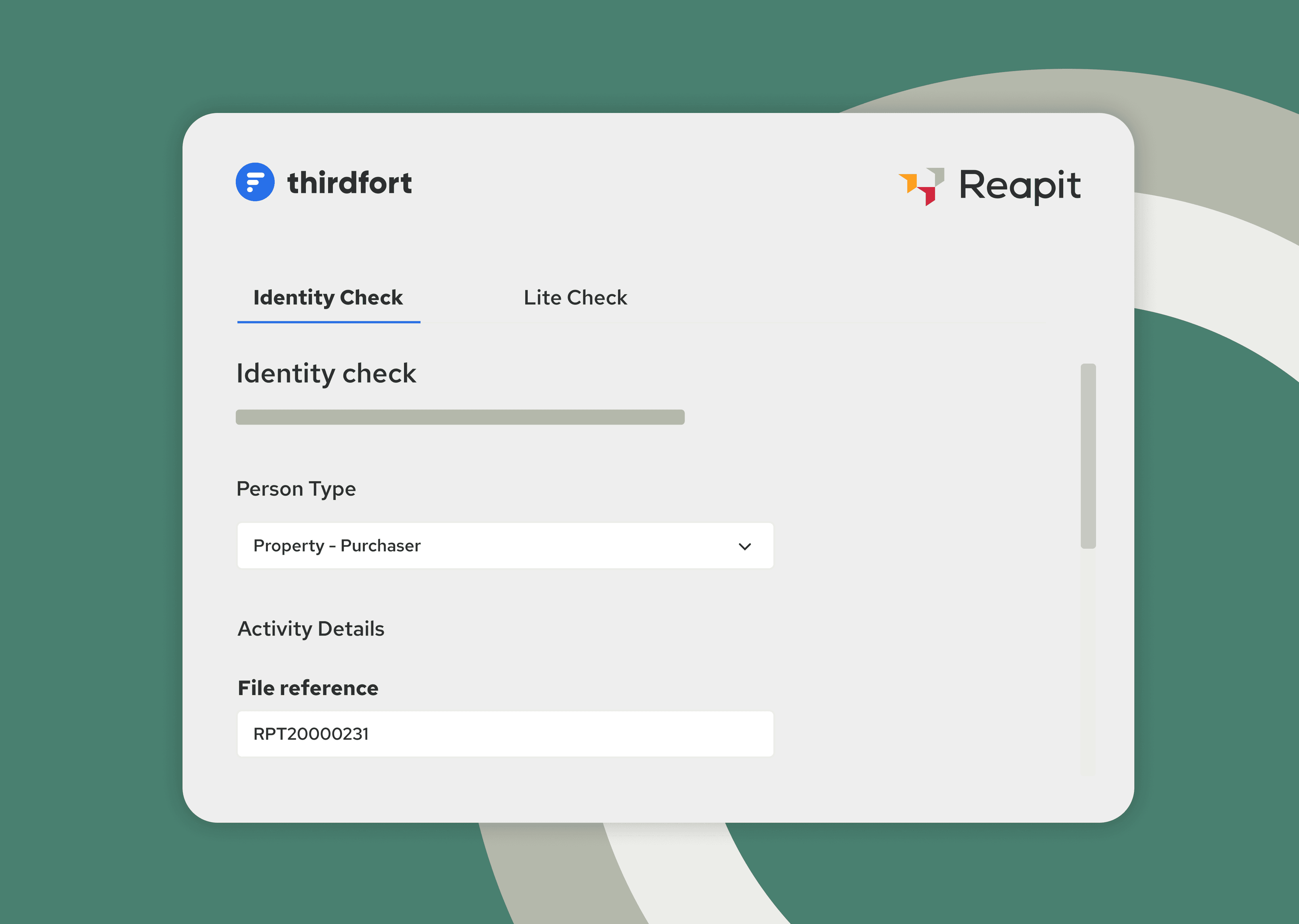

An AML solution, integrated into Reapit

Reapit is the original, end-to-end business technology provider for estate agencies of all sizes, helping agents to build relationships and grow their businesses for more than 25 years. Our digital ID verification, PEPs and sanctions screening and proof of funds features are built into Reapit. Initiate checks without re-entering information, receive results and review red flags without leaving Reapit.

Secure. Compliant. Speedy.

Discover how you can reduce admin and free up time with our electronic ID verification and AML checks for individuals and businesses.